The top mortgage banks in Nigeria play a crucial role in helping individuals and families finance their dream homes. Why? Property prices are soaring.

However, navigating the mortgage options can be hard, especially with varying rates, requirements, and regulations.

This article explores the Nigeria’s top mortgage banks, as well as institutions outside the commercial banking system who have been solidly behind the culture of mortgage in the country – offering housing finance, and other home loans. We will also talk about what to know before signing a mortgage agreement.

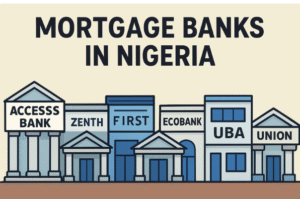

Top 10 Mortgage Banks in Nigeria

Below are ten commercial/retail banks (or major lenders) in Nigeria that offer mortgage/home‐loan services (note: not all are pure “mortgage banks” but they have mortgage product offerings).

1. Access Bank Plc – As Nigeria’s largest bank by assets, Access Bank offers a range of loan products including mortgages. This bank is suitable for everyone; both big and small borrowers.

2. Zenith Bank Plc – A major commercial bank which has mortgage lending among its credit products. Known to shell out huge sums when required.

3. First Bank of Nigeria Limited – One of the oldest and most respected banking institutions in the country. It mostly offers mortgages via its subsidiary/affiliates, offers home-purchase and construction finance.

4. Stanbic IBTC Bank Plc – Offers mortgage and housing-finance products among its suite of services. However, this bank is mostly seen as reserved for the elites.

5. Ecobank Nigeria Plc – A solid bank that has a strong presence in the country. Licensed to provide residential & commercial mortgage lending.

6. Fidelity Bank Plc – A commercial bank that has stood out in providing credit to build up the real sector; including the provision of mortgages.

7. UBA Plc (United Bank for Africa) – While not always singled out in lists of “top mortgage banks in Nigeria”, UBA is a large bank and offers housing finance.

8. Guaranty Trust Bank Plc (GTBank) – Included among banks with mortgage-loan interest rates in Nigeria. One of the most popular brands in the country.

9. Union Bank of Nigeria Plc – Another one of the oldest banks in the country; well known for providing mortgage loan facilities.

10. Citibank Nigeria Limited – Included in the Central Bank list of “deposit money banks licensed to provide residential & commercial mortgage lending”. A private banking institution which stems from an American bank.

Why these banks matter for mortgage finance

- These are large, well-capitalised institutions with broad branch/agency networks — which means greater accessibility for borrowers.

- They often have the infrastructure and regulatory clearance (via the Central Bank of Nigeria) to originate and service mortgage loans.

- They may provide the “anchor” for the mortgage market (in terms of offering long-term housing finance) even if they are not pure specialist mortgage institutions.

Some caveats

- Just because a bank offers a mortgage product doesn’t mean it is optimised for long‐term 20–30 year housing loans (which are standard in many mature markets).

- Interest rates in Nigeria for mortgages remain high (discussed later).

- Customers still often face stricter criteria, shorter tenors, and higher risks than in more developed mortgage markets.

Specialist Mortgage Institutions (Non-bank or dedicated mortgage firms)

These are institutions whose primary focus is mortgage/housing finance rather than full commercial banking. Sometimes a specialist in an industry can be better than a generalist – even if the generalist is bigger.

Here are a few:

Federal Mortgage Bank of Nigeria (FMBN) – The government-backed apex mortgage institution, established to facilitate housing finance and to regulate/support the primary mortgage banks.

Nigeria Mortgage Refinance Company Plc (NMRC) – A specialised entity set up to develop the primary and secondary mortgage markets in Nigeria by providing long‐term funding for mortgages and purchasing mortgages from primary lenders.

Abbey Mortgage Bank Plc – A primary mortgage bank (PMB) focusing purely on housing finance rather than full commercial banking. This bank takes big and small customers.

Infinity Trust Mortgage Bank Plc – Another PMB specialising in residential mortgages, licensed in 2002/2003.

Platinum Mortgage Bank Ltd – PMB incorporated in 1992, now considered among the better specialist mortgage institutions.

What these specialist institutions offer

- Focused product offering and deeper expertise in housing/mortgage finance compared to general banks.

- Tailored products (construction loans, home-purchase, NHF scheme linking) targeted at housing rather than general credit.

- Facilitation of long‐term funding via entities like NMRC helps improve the viability of mortgage lending.

Why Mortgage Uptake Is Low in Nigeria

Despite the presence of these banks/institutions, the mortgage market in Nigeria remains small relative to housing need. Some barriers include:

High interest rates – Many banks charge mortgage‐rates in the range of 15%–28% per annum, which is expensive for many borrowers. This automatically makes mortgages unattractive to the majority of people in the country.

Shorter tenors / mismatch of maturities – Mortgage lending often lacks the very long maturities (20-30 years) common in other countries, which raises monthly payments and makes servicing harder.

Risk and economic instability – The Nigerian economy has higher inflation, currency risks, and regulatory/legal uncertainties, which heighten risk for lenders and borrowers.

Collateral & credit history requirements – Many potential borrowers lack formal employment, full credit records, or clean title to property/land, making qualification difficult.

Low housing finance culture / preference for incremental building – Many Nigerians prefer to build their homes gradually using savings rather than take on long‐term debt. > “Because it’s difficult to plan long term in Nigeria, hence long term loans are almost non existent.”

Inadequate long‐term funding for mortgage lenders – Lenders may have limited access to cheap long‐term funds, making it costly to lend long term at low rates.

Land and title issues / lack of standard mortgage legal framework – This has been an everlasting issue in Nigeria because land titles are seldom clear. This is why you sometimes hear about entire estates or communities being demolished. Issues with property registration, land rights, and enforcing mortgages make lenders cautious.

Because of these factors, mortgage finance remains somewhat under-penetrated, catering largely to higher-income earners, civil servants or those with strong credit histories, rather than the mass middle class.

What to Look Out for Before Signing a Mortgage Agreement

Please shine your eyes very well. Read the small print before you sign any document. In fact, contact a lawyer to interpret anything that seems ambiguous. If you’re considering taking a mortgage in Nigeria (or anywhere), here are important factors and tips to keep in mind:

Interest rate and how it’s structured

- Is the rate fixed or variable? If variable, how often does it reset, and based on what index?

- What is the effective annual rate when fees and charges are included?

- Compare rates across lenders; a spread of several percentage points can make a large difference over time.

Loan tenor (duration) and schedule

- Longer tenors reduce monthly instalments but may cost more in total interest.

- Check whether the mortgage is amortising (principal + interest) or interest-only for some period.

- Be clear what happens if you want to prepay, refinance, or sell the property early.

Down payment / cash requirement

- What portion of the property value must you bring as down payment?

- Some schemes (especially government-backed) may require smaller down payments.

- Note any required savings or contributions (e.g., via the National Housing Fund (NHF) or employer-linked schemes).

Fees and other charges

- Up-front appraisal/valuation fees, legal fees, land registration fees, mortgage documentation fees.

- Ongoing fees: insurance (property & borrower life/credit), account servicing, penalty for prepayment.

- Hidden costs: some lenders may require you to pay for property/house insurance via them, or impose administrative charges.

Security / collateral & property title

- Ensure the property has clean title, registered land, and no encumbrances.

- Confirm who holds the title during the loan term (usually property remains collateral).

- Understand what happens in the event of default: how is property repossessed, what rights you have.

Repayment terms and flexibility

- What is the monthly payment? Will it remain stable? If interest rate increases, will monthly payment increase?

- Can you make extra repayments without penalty? Can you refinance or restructure if your income changes?

- Are there grace periods, holiday payments, or options to convert (e.g., from construction loan to home loan)?

Insurance and protection

- Is life/critical illness insurance required so that in case of death the loan is paid off or reduced?

- Is property insurance required (against fire, natural disaster, etc.)?

- Are these built into the cost, or paid separately by you?

Regulatory/contract clarity and lender credibility

- Make sure the lender is properly licensed (commercial bank or primary mortgage bank) and regulated.

- Read the loan/mortgage agreement carefully. Watch out for ambiguous clauses (e.g., assignment of loan, balloon payments, variable rate triggers).

- Seek legal/financial advice if necessary before committing.

Exit strategy

- What happens if you want to sell the property before the loan is fully repaid? Are there prepayment penalties?

- If you lose your job or your business underperforms, is there a risk of penalty or immediate default?

If property values fall, is there risk of owing more than the property is worth?

Currency/inflation risk (specific to Nigeria)

- Because of inflation and currency devaluation, ensure that your income stream can keep up with increased costs or variable rates.

- In Nigeria, if your income is in naira, but interest/costs escalate, your servicing burden may increase unexpectedly.

Conclusion

Mortgage banks in Nigeria are evolving: there are specialised institutions and major banks offering home loans, but significant barriers remain for broader uptake. For a prospective borrower, the key is doing your homework: compare lenders, check the product terms thoroughly, ensure the property is solid, and align the mortgage with your long-term financial capacity.

Get in touch with a real estate agency to help you find which banks offer favourable terms for mortgage agreements. That could help you achieve your real estate goals sooner than you imagined.